Navi Loan App Review – Is Navi App Safe?

If you’re looking for an honest Navi App Review, you’re in the right place. Navi is a popular app with over 10 million downloads and 1.5 million happy and satisfied users, has caught your attention. But is it the right app for your personal loan needs?

This article is like your friendly guide to Navi, the app that’s getting a lot of talk. Here’s the big question: Is Navi Fake or Real?

Whether you’re a new borrower or just want to get information about Navi, we’re here to help you. After reading this article, you’ll know if Navi is real or not, and if it’s the right app for your money needs. So follow this article till the end.

Quick view of Navi Loan App:

Here is the quick overview of Navi Loan App.

| Interest Rate | Starting at 9.9% p.a. onwards |

| Loan Amount | Up to Rs 20 lakhs |

| Loan Tenure | 3 months to 6 years |

| Processing Fees | Nil |

| Quick Approval | Instant approval for eligible applicants |

| EMI Flexibility | Flexible EMI options tailored to your budget |

| Minimal Documentation | Streamlined documentation requirements |

| No Hidden Charges | Transparency with no processing fees |

| Repayment Options | Multiple repayment methods available |

| Wide Applicability | Loans accessible to a broad range of borrowers |

| Online Application | Easy and convenient online application process |

What is the Navi Loan App?

The Navi Loan app launched in 2020, aims to simplify personal loan acquisition, offering users a quick and convenient way to access the funds they need. The app claims that you can secure up to Rs 20 lakh within minutes with just a few clicks.

Who is the owner of the Navi App?

Sachin Bansal, ex-CEO of Flipkart is the owner of Navi Loan App.

Navi Loan App Review, Fake or Real?

Navi loan app appears to be a genuine and reliable option for individuals seeking short-term loans because of the following features.

- User Feedback: While some users have encountered issues, the majority express satisfaction with their Navi loan app experiences, indicating a generally positive trend.

- RBI Approval: The fact that Navi has secured approval from the Reserve Bank of India (RBI) adds a layer of credibility and trustworthiness to the app’s operations.

- New App: Being a relatively recent entrant to the market, Navi may experience occasional technical glitches. However, the company is proactive in addressing and resolving these issues as they arise, demonstrating a commitment to improvement.

- Positive Ratings: The Navi loan app has amassed positive reviews and attracted millions of downloads on the Play Store. This sets it apart from fraudulent loan apps, which typically receive low ratings due to their unscrupulous practices.

- Transparency: Navi places a strong emphasis on transparency in its dealings with users, ensuring clear communication channels that foster trust.

- Customer Support: The app provides 24/7 customer support, which can be valuable for users seeking assistance with any concerns or issues.

- Regulatory Compliance: Navi adheres to regulatory guidelines set by the RBI and complies with industry standards, which means users can expect a certain level of protection and fairness in their interactions.

- Regular Updates: Users can benefit from regular app updates that not only enhance the overall user experience but also reinforce security measures.

- Security Measures: Navi incorporates robust security protocols to safeguard user data and ensure secure financial transactions, adding an extra layer of confidence.

Important Note :

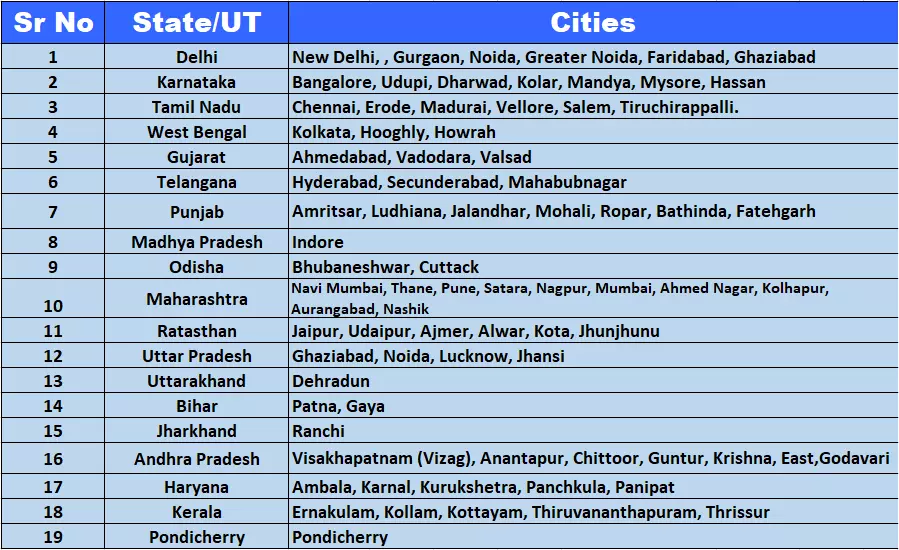

The Navi loan app is currently available in specific states, so its services may not be accessible to users residing outside of these areas.

Who Can Access Navi Loan App Services?

Before writing this article our team did indepth research on this app. We came to know that to avail loan services of Navi you must be 18 years old or above. Moreover, only Indians can use its services.

But during our research we came to know that the Navi App does not cover all areas of india. It is available only in specific areas of india. So before availing its services you must confirm that you are a resident of the following areas.

How to Get a Loan Using the Navi Loan App?

Whether you’re seeking a personal, home, or student loan, the Navi loan app is a versatile choice for your financial needs.

Download and Register:

Download the app and create an account by providing basic information like your name, address, and Social Security number.

Loan Selection:

After logging in, explore the available loan options and choose the one that aligns with your financial requirements.

Application Submission:

Complete the loan application and submit it for approval.

Fast Approval:

If your application is approved, you can expect the loan amount to be deposited into your account within 24 hours.

Timely Repayment:

Ensure you repay your loan in full and on time to avoid penalties or fees, maintaining a healthy financial record

Features of Navi Loan App:

The Navi Loan App offers a wide range of user-centric features, simplifying the loan process for a broad audience. From flexible loan tenures to customized EMI options, it provides accessibility and convenience to suit a variety of financial needs. Explore the features that make Navi an appealing choice for borrowers.

Disadvantages of Navi Loan App:

Drawbacks of Navi Loan App Usage:

After highlighting Navi App’s features, we are bound to mention all drawbacks which were found during our research. Keep following drawbacks in your mind before availing loan.

Required Documents for Navi App Loans

Processing Fee:

- 2.5% of the loan amount

- Minimum fee of Rs 500

- Maximum fee of Rs 5000

- Excludes 18% GST charge

Final Words:

Navi Loan App, with over 10 million downloads and over 15 lakh satisfied customers, is a promising option for personal loans. Use it responsibly for urgent needs, as Navi has processed loans worth 7600 crores and sold over 53,000 health insurance policies, affirming its credibility. It’s a legitimate choice, so proceed wisely and plan your finances carefully.

Deepak Sharma

Namaste! I’m Deepak Sharma, the creative mind behind SocialFunda, your go-to hub for Facebook bios, captivating captions, Instagram bios, and a treasure trove of Hindi Shayari. As a digital enthusiast, I am passionate about curating content that adds a touch of flair to your online presence.